Islamic Banking Rules, Institutions, and Influence

Islamic Banking Rules

By: Arielle Russell

Islamic banking refers to a system of banking that follows the principles of Shari’ah (law of Islam). Islamic banking has the same purpose as conventional banking except that it operates under the rules of Shari’ah known as Fiqh al-Muamalat.[1] The Quran is the main source of Shari’ah, as well as the Hadith (recorded actions and sayings of the Prophet Muhammed).

The Quran

by Ranoush, used under

The Islamic banking system has its origins with the birth of Islam itself in 622 A.D. Muhammed himself acted as a partner in his wife’s trading operations. These “partnerships” known as mudarabah, dominated the business world for many centuries.[1] The partnerships combined three important factors for production- capital, labor, and entrepreneurship. The person who had capital contributed the money and the partner managed the business. Both shared any profits made, and if there was a loss, the capital owner lost money and the partner lost his time and labor.

Gold Dinar Coins

by mhaithaca, used under

Islamic forms of insurance, known as takafful and tadamun, provided mutual guarantees against the risks both parties faced.[2] “Islamic capitalism”, an early form of a market economy, was developed between the 8th and 12th centuries. The currency used widely at the time was the gold dinar. Islamic merchants were indispensable for trading activities, in the Mediterranean and Baltic regions of the world.

In Islamic culture, “worldly success” is viewed as a blessing from Allah. But if that success is gained through individual self-interest, it is frowned upon because it goes against the public good and the needs of the community. Muslims must participate in activities, including all economic activities, that do not exploit their fellow Muslim brothers and sisters. Interest, known as Riba, is banned on the “grounds that it benefits the provider of finance at the cost of those who do the work,” and it is the most prominent feature of this system.[2] Excessive speculation is also prohibited. It is seen as promoting “the individual’s interest at the expense of those who produce goods and services needed by the community.”[2] To comply with the principles found in the Quran, Muslims must share the potential for both profits and loss rather than setting a fixed rate of return on their investments before undertaking projects.[3] Other notable rules of Islamic banking include Mudharabah (profit sharing), Bai’ Bithaman-Ajil (deferred payment sale), Murabahah (cost plus), Musyarakah (joint venture), Ijarah Thumma-Bai’ (hire purchase), Wakalah (agency), Qard (interest-free loan), and Hibah (gift).[3]

Islamic Banking Institutions

By: Philip K. Smith

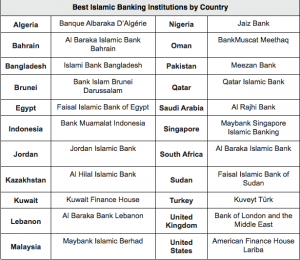

A look at some of the best Islamic Banking Institutions in various countries.[8]

Created by: Phil Smith

During the seventies there were four major conferences between many of the Islamic nations to establish the philosophy behind these institutions, begin involving the governments of these nations, and to start implementing these institutions throughout the Islamic world.[4]

In 1975, the Dubai Islamic Bank was established as the first modern and commercial Islamic financial institution in the United Arab Emirates. In the same year the Islamic Development Bank was opened in Saudi Arabia. At the end of this decade more diverse Islamic financial institutions began to emerge with the opening of the first Islamic insurance (takaful) company, the Islamic Insurance Company of Sudan.[7] Another first came a decade later with the opening of the first Islamic mutual fund. This company, The Amana Income Fund, was founded in 1986 in none other than Indianapolis, IN.[5]

Throughout the remainder of the century Islamic finance institutions continued to grow and flourish throughout the world. By 2004, the first Islamic commercial bank outside of the Islamic world was established in Great Britain. Today more than 500 Islamic financial institutions exist in the world in more than 75 Islamic and non-Islamic nations.[6]

FTTheBanker. “Top Islamic Financial Institutions 2013.” Online video clip. YouTube. YouTube, 29 July 2013. 4 Dec 2013.

Islamic banking institutions serve many of the same purposes that do conventional Western banks, they simply approach these purposes from a different angle, one with a strict moral code. This, however, does not stop them from being some of the most powerful institutions of business in the world.

Islamic Banking Influence

By: Gayle Ocampo

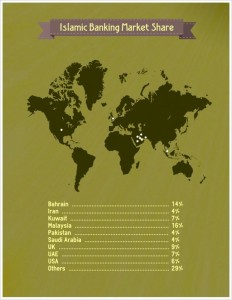

Islamic banking became prominent around 1970’s due to the oil boom,with the first bank located in Egypt. Since then, there has been a rise of Islamic banks. [9] Though Islamic banks are mainly attributed to the Middle East, it is not the only region experiencing exponential growth— the practice of Islamic banking is noticeable throughout the world. Globally, there are roughly 50 countries that have Islamic banks.[10]

Market Share of Islamic Banking[10]

Created by: Gayle Ocampo

However, a majority of the banks are still found in the Middle East. In 1979, the Pakistani government set orders to switch from western banking practices to Islamic banking. To this day, Pakistani banks are strictly Islamic and void of any western influence. [9]

In Malaysia, Islamic banking practices are prominent and are regulated in parallel with the conventional system. The importance of Islamic banking practices can be seen with regulation of their national bank, Bank Negara Malaysia (BNM) and their Securities Commission.[11]

Islamic Bank in Malaysia

by Albert Freeman, used under

Both have Shari’ah advisory councils to ensure that the Islamic capital market products follow the Shari’ah principles. With the growing demand for Islamic banking in the country the BNM, in conjunction with the International Shari’ah Research Academy for Islamic Finance (ISRA), is working to help grow the sector. Industry-wide, it is recognized that there is a need for more research and development (R&D) to spread knowledge of Islamic banking.[11]

Islamic banking is a continually growing practice throughout the world. As Islam continues to grow and spread, there will always be a demand for more Islamic banks. For more information about Islamic Banking, click here for a video.

———————————————————————————-

References:

1. Institute of Islamic Banking and Insurance. (2013). Islamic Banking Principles. Retrieved from http:// www.islamic-banking.com/what_is_ibanking.aspx.

2. Smith, P. (1984, November, 23). Islamic banking rules reflect the tenets of Muslim Holy Book; worldly success is seen as a sign of Allah’s blessing, but self-interest conflicting with public good, is tabu. Retrieved from http://bi.galegroup.com/essentials/article/GALE%7CA3528692/0f8798ece215c8f386c7d0550a6c3d8a?u=butleru.

3. (2009). Basic Concepts and Principles of Islamic Banking. Retrieved from http://www.bankinginfo.com.my/_system/media/downloadables/islamic_banking.pdf

4 . Gafur, A. (1995). Interest-free and commercial banking. Groningen, Netherlands: Apptec.

5. About amana mutual funds trust. (2013, December 2). Retrieved from http://www.amanafunds.com/retail/amanx.shtml

6. Ahmed, B. (2008). Islamic banks and financial stability: An empirical analysis discussing the results of an imf paper. Journal of King Abdulaziz University-Islamic Economics, 21(2), 69-93

7. Friedman, J., & Faleel, J. (2012). Islamic finance for dummies. Hoboken, NJ: Wiley.

8. Fiano , A. (2013, April 19). World’s best islamic financial institutions 2013. Retrieved from http://www.gfmag.com/tools/best-banks/12474-worlds-best-islamic-financial-institutions-2013.html

9. Ashraf, Kazi., & Abdel, Halabi. (2006). The influence of quran and islamic financial transactions and banking. Retrieved from http://www.jstor.org/stable/27650555

10. Fortune, S. (2009, June 24). Islamic banking gains momentum globally. Retrieved from http://www.pressreleasepoint.com/islamic-banking-gains-momentum-globally

11.Hawser, A. (2010). When Two Worlds Collide: Islamic finance is set to become one of the defining phenomena of the coming decade. Some are concerned, though, that the surge of growth may compromise the strict principles on which it is founded. Global Finance, 24(1), 29-31.

This page was last updated on December 5, 2013.