What do financially healthy people do? This is an important question to ask on your quest to becoming financially healthy. What better way to achieve a goal than to mimic those who have already walked the path before you? Identify someone in your orbit who has a smart financial life. How do you identify this person? Likely they have no consumer debt. They live in a home that doesn’t exceed their means. They save up for new projects and vacations. They don’t say “yes” to every purchase opportunity. Once you’ve identified this person, ask them to coffee. Pick their brain. Don’t be shy! Your financial life is on the line, and as a financially healthy person they will absolutely see the value in imparting their wisdom on you. This is a big challenge, but it’s one that will benefit you for years to come. Allow their mistakes to prevent yours.

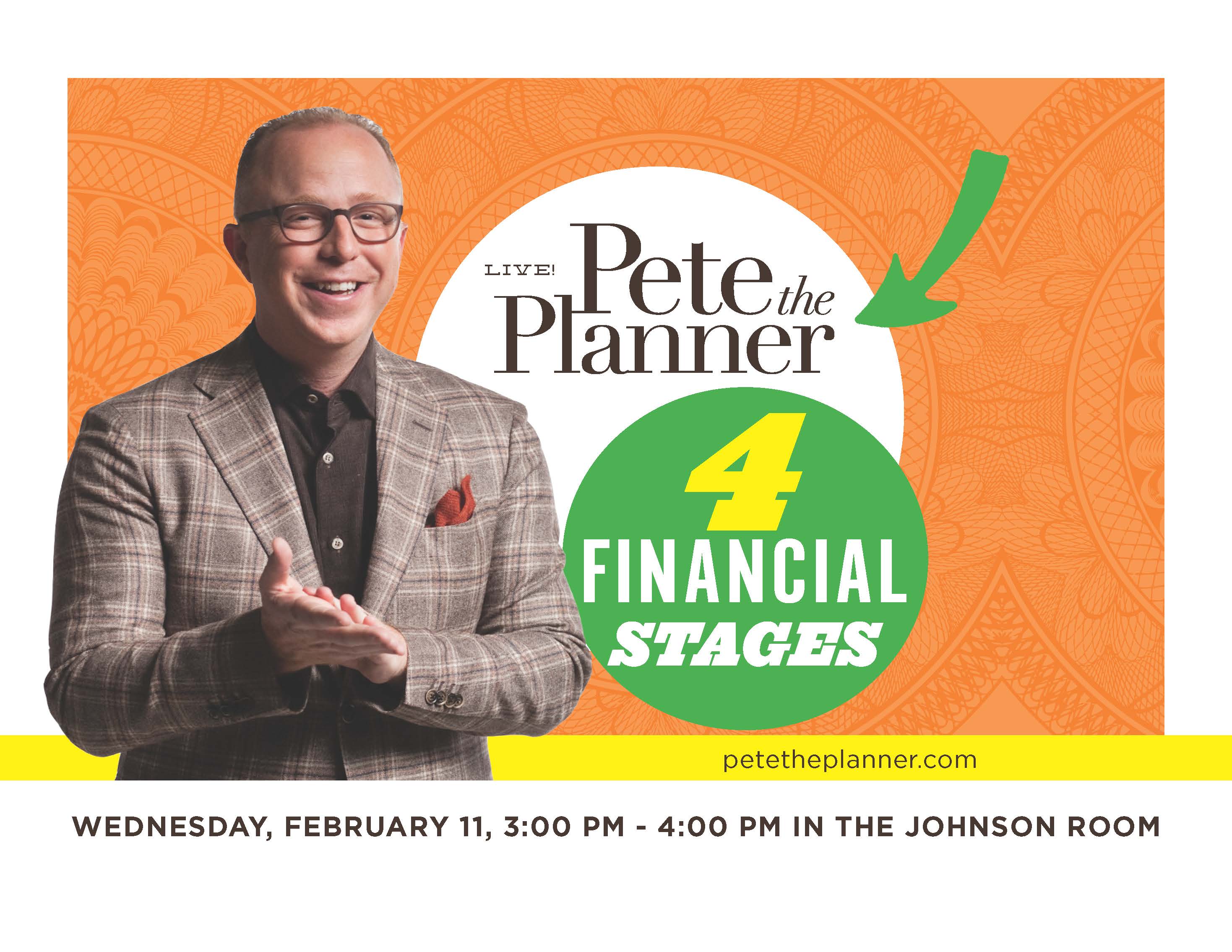

From: Pete The Planner![]()